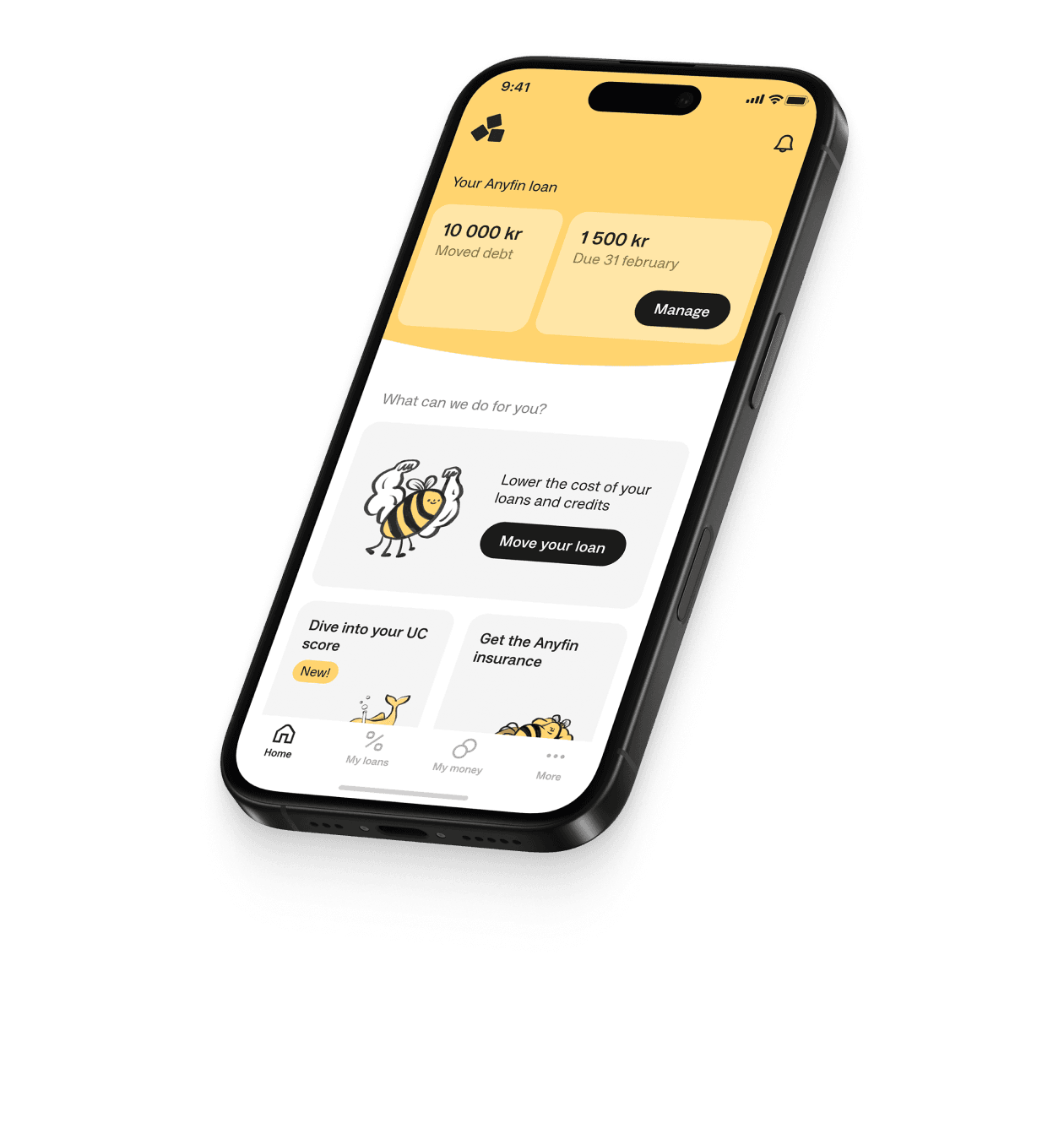

Challenge your old terms

Refinance and repay your loans with Anyfin. Apply with part payments, credit cards and private loans.

Borrowing costs money!

If you are unable to repay your debt on time, you risk receiving a payment remark. This can lead to difficulties in renting a home, signing contracts, and obtaining new loans. For support, contact the budget and debt counselling service in your municipality. Contact details are available at konsumentverket.se.

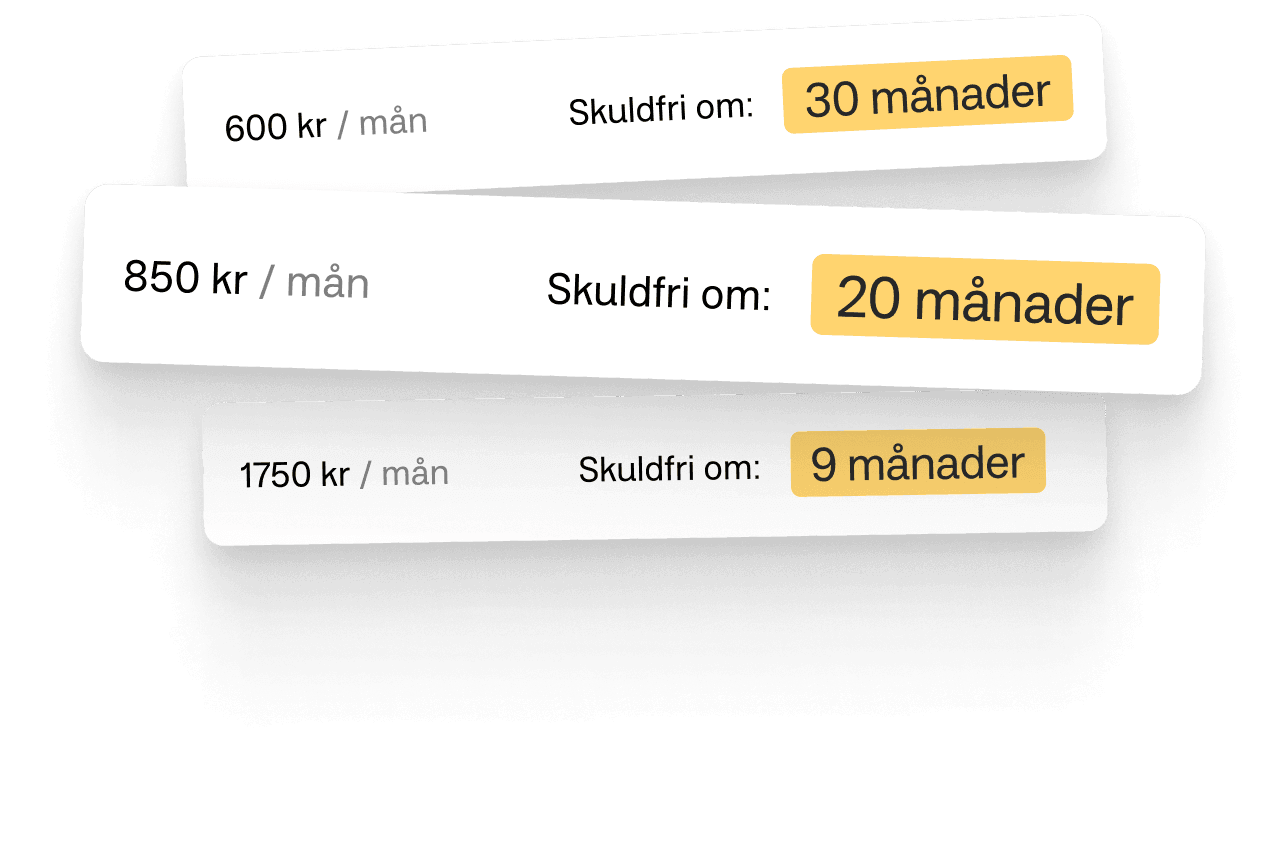

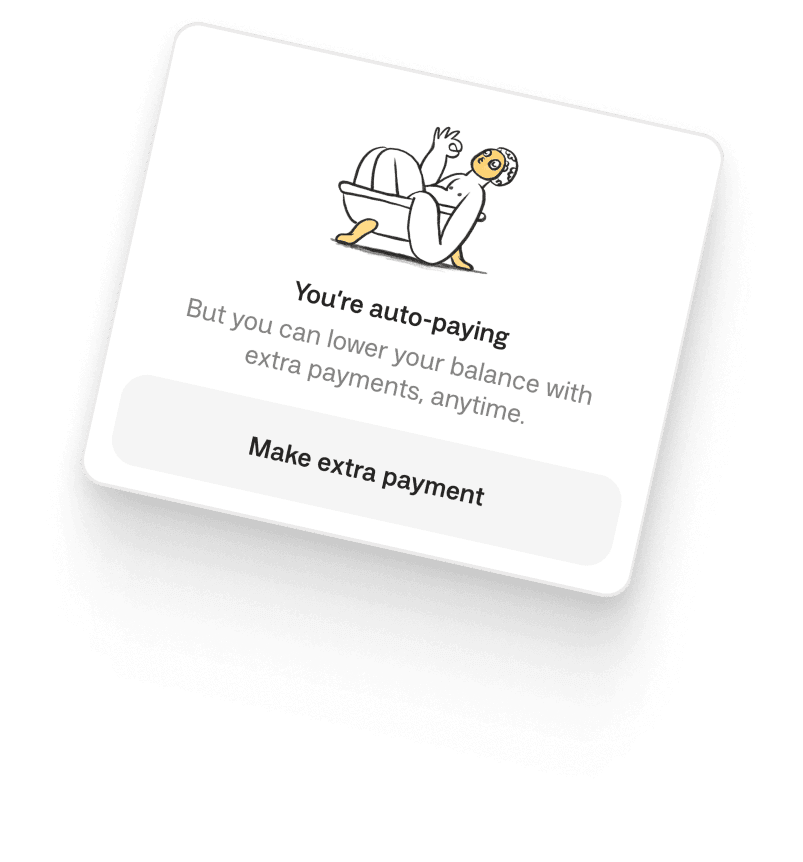

Choose your repayment plan

Do you want to pay off your debt as quickly as possible, or pay the minimum amount each month? Customize your payment plan in the app and make extra payments whenever it suits you.

So far in 2025, our customers have repaid over 1 billion SEK.

Last updated:

8 July 2024

1 480 452 042

Get the app that helps you pay back.

Scan the QR-code to download it.

Borrowing costs money!

If you are unable to repay your debt on time, you risk receiving a payment remark. This can lead to difficulties in renting a home, signing contracts, and obtaining new loans. For support, contact the budget and debt counselling service in your municipality. Contact details are available at konsumentverket.se.

Anyfin AB, Drottninggatan 92, 111 36 Stockholm. Org. number: 559094-8005 © 2026 Anyfin AB is a credit market company and is under the supervision of Finansinspektionen. All rights reserved.

Representative example

A refinancing loan of 39 000 SEK at 13,44% nominal interest rate with a repayment period of 60 months, with 60 installments of 896 SEK, results in a total effective interest rate of 14,30%. The total repayment amount will be 53 771 SEK. The maximum amount that can be refinanced with Anyfin is 500 000 SEK. The loan term can be as short as 1 month and as long as 120 months, depending on the current term. The nominal interest rate can range from a minimum of 4,36 % to a maximum of 22,00 %. The effective interest rate can range from a minimum of 4,45 % to a maximum of 24,36 %.