Lower your interest rates

Whatever your loan is for, you shouldn't pay too much for it. Lower the interest rates on your part payments, credit card debts, and other personal loans. Anyfin can help you reduce the interest rate of your loans up to 20,000 Euro. Apply now for free and get a non-binding offer!

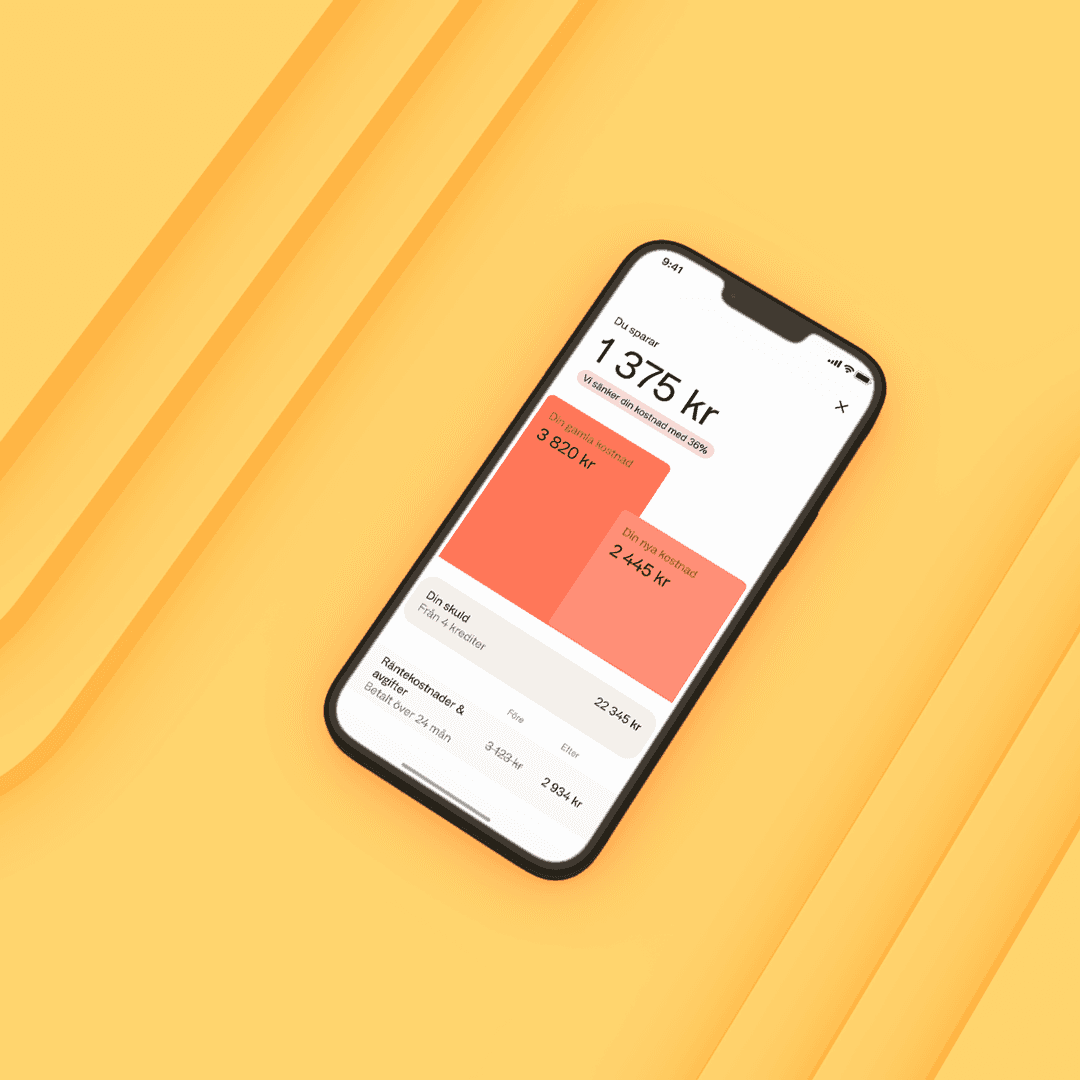

Transparency

We only send you an offer, if we can lower your cost. The process is free, non-binding and has no impact on your Schufa score.

Better overview

The app makes it easy to keep track of all your monthly payments.

Save Money

We pay off your existing loan and you pay back to Anyfin with lower interest rates.

How does it work?

Send an application

Take a picture of your outstanding credit balance, answer some questions and send your application. Download our app for the smoothest experience or apply directly here on the website. An application is free, takes about 2 minutes and is non-binding.

Get your offer

We assess each application individually to make sure you get the best offer possible. We only send you an offer if we can reduce your costs.

Your credit is paid off

If you accept your offer, we will pay off the credit to your current lender and transfer the loan to Anyfin. You can just lean back and watch.

Pay less with Anyfin

Pay off your loans with lower interest rates and improved terms at Anyfin.

Lower your interest rate

I used Anyfin to cut my creditcard costs into half and got into a way better plan. I also love the app and the whole process is secure and professional. Definitely coming back when needed. Thank you heaps!

Trustpilot

Andreas

What makes Anyfin Anyfin?

Far too many people pay far too much interest and fees for their credits - too much in terms of common sense, but especially considering their creditworthiness. We think that is unfair and thus want to help you lower interest rates on installments, credit card debts and personal loans. When you apply at Anyfin, we assess your application individually and see if we can offer you a better interest rate and conditions based on your specific circumstances.

A little bragging

36%

We lower credit costs on average by

1.000.000 +

App downloads

Our customers' average saving after transferring their loans and credits to us is 36%. This number refers to the interest and fees saved on all transferred loans during the period 2021-08-01 and 2022-08-01.

How can Anyfin make it cheaper?

We always offer our users individual interest rates. So instead of giving everyone the same offer, we do an individual credit check. In addition, we have fully automated processes that keep costs down down down. But most likely of all, your current lender is probably taking more money than they should.

Which credits can I refinance?

We can help you with installments, credit card bills, personal loans and other similar credits up to 20,000 Euro.

Can I make extra payments?

You can contribute to paying your loans off more quickly with extra payments anytime, without any additional costs.

What does Anyfin need from me?

To refinance a credit with us, there are some criteria you need to meet. You need to be at least 18 years old and have a bank account in Germany. You must have a stable income from work, or alternatively a parental benefit, pension or sickness benefit (we do not accept Bafög, housing benefit, social assistance, activity support or unemployment benefit). You must also not have a payment note from within the last 12 months, or an active debt balance with the Schufa.

Can I apply in English?

Unfortunately our application flow is not available in English yet. If you need help during the application, click the little chat icon and talk to our customer support - they are all happy to help in English.

Questions? Ask!

Our team of the most helpful people around is always ready. Ask them anything, anytime and almost wherever (call, chat or email).

We lower loan costs on average by 36 %

Anyfin AB, Drottninggatan 92, 111 36 Stockholm. Handelsregisternummer: 559094-8005 © 2026 Anyfin AB ist ein Kreditmarktunternehmen und untersteht der Aufsicht der schwedischen Finanzaufsichtsbehörde. Alle Rechte vorbehalten.

Angaben gemäß § 17 Abs. 2 und 3 PangV:

Konditionen (bonitätsabhängig): Nettodarlehensbetrag aller refinanzierten Darlehen pro Kunde 10,00 € bis 20.000,00 €, effektiver Jahreszins 7,87 % - 16,38 %, variabler Sollzinssatz p. a. 7,60 % - 15,27 %, Laufzeit in Monaten/Anzahl Raten 1 bis 120, monatliche Rate 10,06 € bis 339,78 €, zu zahlender Gesamtbetrag 10,06 € bis 40.773,33 €. Repräsentatives Beispiel gemäß § 17 Abs. 4 PAngV: Nettodarlehensbetrag 500,00 €, effektiver Jahreszins 12,30 %, variabler Sollzinssatz p.a. 11,66 %, Laufzeit in Monaten/Anzahl Raten 18, monatliche Rate 30,41 €, zu zahlender Gesamtbetrag 547,40 €. Bonität vorausgesetzt. Darlehensgeber: Anyfin AB, Drottninggatan 92, 111 36 Stockholm.